|

Notice: The information on this page is only for users of Personal Taxprep 2018. If you are using Personal Taxprep Classic 2018, consult the help available in the program. |

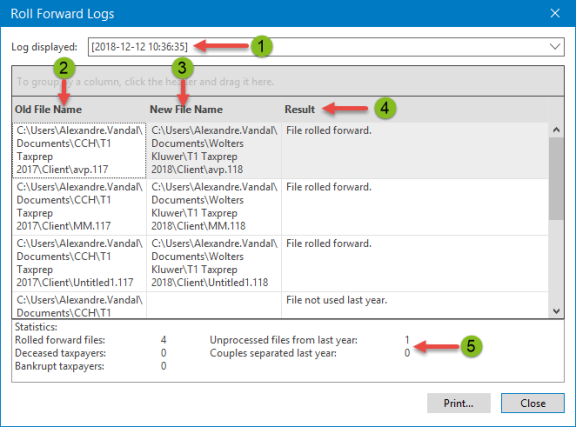

Roll Forward Log

Personal Taxprep will display a log immediately following a roll forward if the appropriate option is selected. You can also display the log for a previous roll forward. This log contains the list of files processed and, for each client file created, the results of the roll forward as well as the following information:

|

|

The date and time when the roll forward log was created. |

|

|

The location and name of the client file where the data was rolled forward from. |

|

|

The location and name of the client file where the rolled forward data has been saved. |

|

|

The result of the roll forward. An error message is displayed for each error that has occurred. |

|

|

The statistics about the roll forward operation that took place. |

By default, Personal Taxprep keeps the last five most recently created roll forward logs. The number of saved logs can be modified.

To automatically display the log following a roll forward, proceed as follows:

- On the Tools menu, click Options and Settings.

- Under Roll Forward, click File Options.

- In the Options area, select the Show log after roll forward check box.

- Click OK.

If you want to consult a log for a previous roll forward, proceed as follows:

- On the Tools menu, click Roll Forward Logs.

- In the Log displayed list, click the log you want to display.

By default, Personal Taxprep saves the last five roll forward logs. To modify this number, proceed as follows:

- On the Tools menu, click Options and Settings.

- Under Roll Forward, click File Options.

- In the Number of roll forward logs box, select the number of logs you want to keep.

- Click OK.